Operating review - 2022-riyad

Review

performance

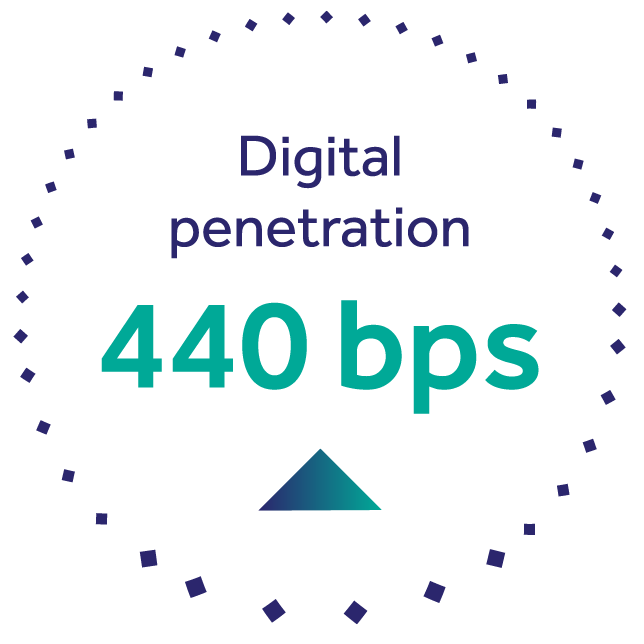

2022 was a profitable, growth-oriented year with a lot of achievements, rooted in an aggressive campaign for digitalization and digital penetration. Innovation served as the foundation of all strategic initiatives, supporting the Division to attain a competitive edge, maximize customer value, and further grow sector activities.

Retail Banking continued to deliver on its strategy during 2022, making progress in line with its strategic objectives and creating value for the Bank. It continued its growth trajectory in assets, and liabilities, while customer deposits grew by 13.4% compared to 2021. Mortgage lending remained the Division’s core product, posting 21% growth for the year.

2022 Retail Banking highlights

Retail Banking coninued to deliver on its strategy during 2022, making progress in line with its strategic objectives and creating value for the Bank.

Net Income

SAR 785 Mn.

Total Deposits

8%

Increased customer base

13%

Contribution to operating income

29.4%

Branches’ NPS improved by

26%

ATMs scored more than the year before

14%

Total relationship value increased

15%

Riyad Bank’s Corporate Banking maintained momentum during 2022 to deliver exceptional results, enabling synergies across businesses, and building future-ready capabilities as embodied in one of our values: " We are One Team". With focus on providing exceptional customer experience across all our services and channels, we accelerated our targeted transformation and innovation to deliver sustainable value for our customers and our business.

This year Corporate Banking continued to develop a strong franchise by supporting the Kingdom’s economic diversification. We financed and facilitated expansion of various businesses from start-ups to large corporates and multinationals. The Division was once again a key player in the Saudi Vision 2030, participating in a wide range of development initiatives financing related to mega projects, privatization, infrastructure, education, healthcare, SMEs, private sector, tourism and entertainment.

2022 Corporate Banking highlights

In 2022, Corporate Banking held its weight by contributing to Riyad Bank’s performance as the fastest-growing bank in the Kingdom. The Division accounted for 49% of the Bank’s total income, compared to 37% in 2021 and it earned 41% of the Bank’s total operating income, compared to 37% in 2021.

Financial transactions initiated digitally

80%

Corporate Net income

SAR 3.84 Bn.

Market share for SME credit facilities

22%

Green and Renewable Banking

Projects financed

28

Total funding

SAR 7.4 Bn.

Outstanding Contribution

to SMEs Award

Euromoney Awards for

Excellence 2022

Best AI and Data Science

Excellence Awards

Best CX and Operational

Excellence in BFSI

Best CX Leadership

Best VoC Transformation

Intelligent Automation

Leader of the BFSI

Intelligent Automation

Operational Excellence

Treasury and Investments is responsible for the management of liquidity and the Bank’s proprietary investments. It also offers a wide range of products and hedging solutions to our corporate and retail customers. The Division accounts for 22% of the Bank’s total operating income.

Treasury and Investments efficiently managed the Bank’s liquidity - maintaining a solid liquidity position and comfortable liquidity and capital ratios to help the Bank’s growth by successfully issuing AT1 Sukuks this year.

Prestigious Achievements and Awards

Awarded Bonds, Loans and Sukuk Middle East Awards Winner for Financial Institutions Deals, presented by GFC Media Group

Bank Treasury and Funding Team of the Year, presented by GFC Media Group

Deal of the Year Award for Regulatory Capital, presented by Islamic Finance News

|

Division |

Capital |

Total Shares |

Ownership % |

Main |

|

Riyad Capital |

500,000,000 |

50,000,000 |

100% |

Carry out trading activities as principal and agent, undertake coverage, establish and manage investment funds and portfolios, in addition to arranging and providing consulting, stock keeping services, portfolio management and trading. |

|

Ithra Al Riyad Real Estate |

10,000,000 |

1,000,000 |

100% |

Keeping and managing assets provided by customers as collateral and a guarantee, and the sale and purchase of real estate for financing purposes for which the company was established. |

|

Riyad Company for Insurance Agency |

500,000 |

50,000 |

100% |

Works as an agent for selling insurance products, including their own and those managed by other main insurance companies. |

|

Curzon Street Properties Limited

|

9,350,760 |

2,000 |

100% |

A company established for the purpose of owning properties. |

|

Riyad Financial Markets Limited |

187,500 |

50,000 |

100% |

Performing financial derivative transactions and repurchase agreements with international parties on behalf of Riyad Bank. |

|

Riyadh Esnad Company for Human Resources |

500,000 |

500,000 |

100% |

Providing operational human resources services exclusively for Riyad Bank and its subsidiaries. |

Awards and Recognitions in 2022

Riyad Balanced Income Fund – Refiniv

Euromoney Market Leaders – Euromoney

Most Innovative REIT Fund – Riyad REIT – Saudi Arabia – Global Business Outlook

Top Performance Fund – Argaam

Best Custodian – Tadawul

Digital transformation is our de facto means of doing business at Riyad Bank and is an ongoing mission covering all areas and divisions. We have expanded our understanding of digitization to make it more customer-centric, focusing on customer challenges, perceptions and expectations.

In 2022, we continued to progress our digital banking story and took important steps in our digital innovation journey, including entering the frontier of open banking and banking as a service (BaaS), putting us ahead of other banks in the Kingdom. Furthermore, our new Digital Innovation Center (Jeel) will fuel the fire to generate new innovative and market-leading products and services, promoting internal entrepreneurship and supporting the larger fintech ecosystem.

At Riyad Bank, our commitment to continuous improvement and growth as a customer-centric organization fuels our aspiration to become the best bank in the Kingdom. As a key success factor in all 4 pillars of our corporate strategy, customer experience continued to be an area of focus, innovation and investment during 2022.

This year, we expanded and sharpened this focus to provide and enhance fully-fledged, end-to-end customer journeys across all divisions. We aggressively pursued our digitization campaign, staying ahead of demand for real-time content and streamlined processes and services. We also elevated the Bank’s branding to reflect our ethos that customers are at the heart of everything we do.

new product- and service-related processes

digital usability tests